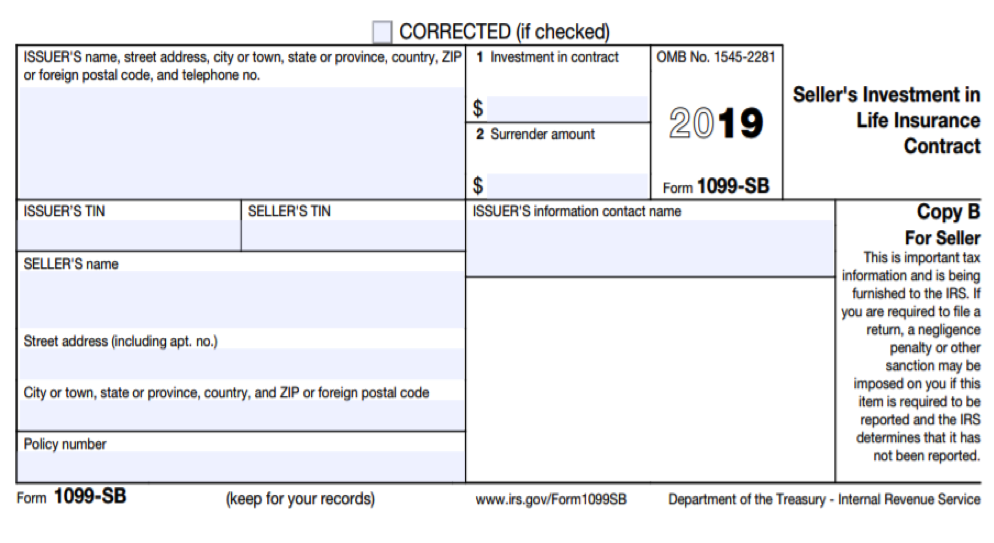

File Form 1099-SB if you are the issuer of a life insurance contract and either of the following occurs

- You receive a statement from an acquirer in a reportable policy sale provided under section 6050Y(a), such as a copy of a Form 1099-LS, Reportable Life Insurance Sale, reporting the transfer of the life insurance contract, or an interest therein, in a reportable policy sale.

- You receive notice of a transfer of the life insurance contract to a foreign person. Notice of a transfer to a foreign person means any notice received by an issuer indicating a transfer of a life insurance contract, including information provided for nontax purposes such as a change of address notice for purposes of sending statements or for other purposes, or information relating to loans, premiums, or death benefits with respect to the contract.

For more information about the requirement to furnish a statement to the seller, see part M in the 2019 General Instructions for Certain Information Returns.

Posted in Form 1099