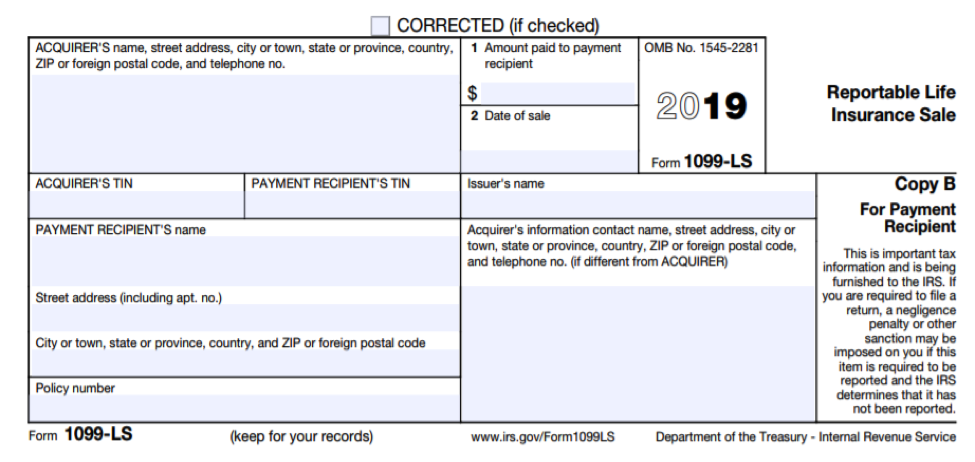

File Form 1099-LS if you are acquirer of a life insurance contract (also known as a life insurance policy), or any interest in a life insurance contract, in a reportable policy sale to report the acquisition. A reportable policy sale is any direct or indirect acquisition of a life insurance contract, or any interest in a life insurance contract, if the acquirer has no substantial family, business, or financial relationship with the person insured under that contract, apart from the acquirer’s interest in such life insurance contract. The acquisition of an interest in a partnership, trust, or other entity that holds an interest in a life insurance contract may be an indirect acquisition of a life insurance contract or an interest in a life insurance contract and may be a reportable policy sale.

For more information about the requirement to furnish a statement to the payment recipient and the issuer, see part M in the 2019 General Instructions for Certain Information Returns.