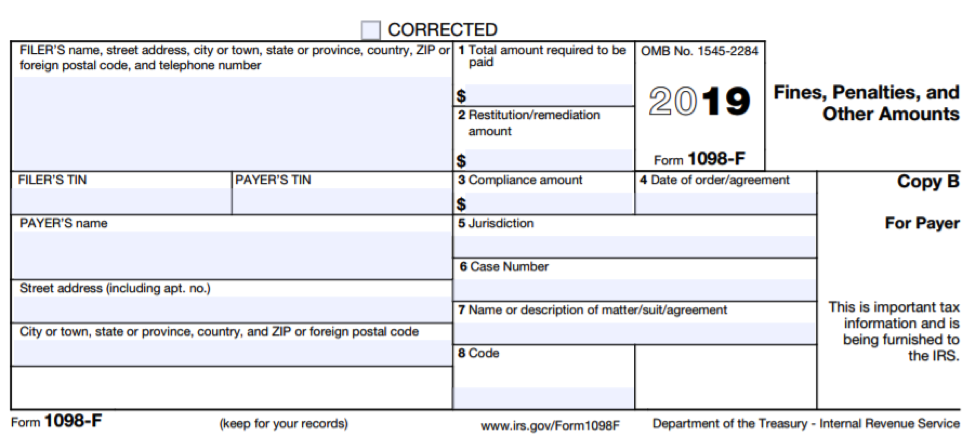

Form 1098-F is a new form required by section 6050X, section 13306 of P.L. 115-97, the Tax Cuts and Jobs Act (TCJA), as enacted by the 2017 tax act (Pub. L. No. 115-97), effective for amounts paid or incurred after December 22, 2017, requiring reporting of certain fines, penalties, and other amounts. The Form and Instructions for Form 1098-F were released February 5 and February 25, 2019 respectively. Section 6050X requires any government, governmental entity, certain nongovernmental entities or other entity responsible for receiving restitution that exercise self-regulatory powers must file a separate Form 1098-F with the IRS for each fine, penalty, or other amount in excess of an amount determined by the Secretary that is paid in relation to any violation of law or investigation into potential violation of law, pursuant to a court order or agreement from a party violating any law in an amount equal to or greater than $600 to file an information return with the IRS.

Box 8 requires one or more of the following codes:

- A—Multiple payments.

- B—Multiple payers/defendants.

- C—Multiple payees.

- D—Property required to be acquired, constructed, or transferred under the court order or agreement.

- E—Payment to third party other than government or governmental entity.

- F—Paid in full as of time of filing.

- G—No payment received as of time of filing.

- H—Deferred prosecution agreement.

Additional information for Form 1098-F can be found on Instructions for Form 1098-F and 2019 General Instructions for Certain Information Returns.