Reporting Dispositions of Qualified Opportunity Fund Investments

A Qualified Opportunity Fund (QOF), whether or not the QOF is a broker or barter exchange, should file Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, for each person who disposed of a QOF investment as defined in section 1400Z-2(d)(1). A Qualified Opportunity Fund (QOF) is an investment vehicle organized as a corporation or a partnership for the purpose of investing in qualified opportunity zone property.

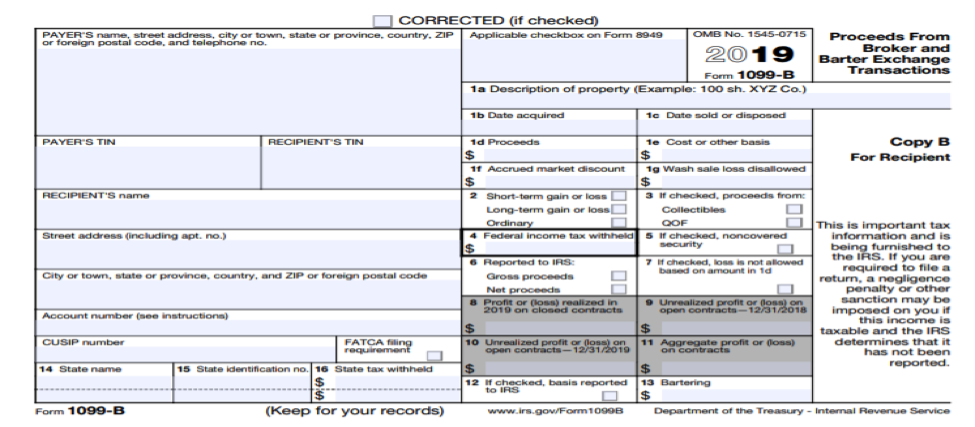

If you are a QOF that is not a broker or barter exchange and do not know that a broker or barter exchange reported a disposition of a QOF investment, then complete the following on the form in the manner instructed for the respective items and boxes.

- Box 1a. For QOF investments, enter the appropriate descriptions. For example, for stock, enter the number of shares or units; for partnerships, enter the percentage of investment.

- Box 1b. Enter the acquisition date of any QOF investment, if known.

- Box 1c. For QOF investments, enter the date of disposition.

- Box 1d. Enter the gross cash proceeds from all dispositions of a QOF investment, if known.

- Box 3. Check the QOF box for reporting the disposition of a QOF investment.

Reporting in boxes 3 and 12

In order to support the inclusion of a new checkbox to indicate that the report is for a person who has disposed of a QOF investment, the contents of boxes 3 and 12 have been switched. The information now contained in box 12 was previously reported in box 3. The appropriate checkbox in box 3 should be checked if reporting a disposition of a QOF investment or collectibles proceeds.