New filing addresses

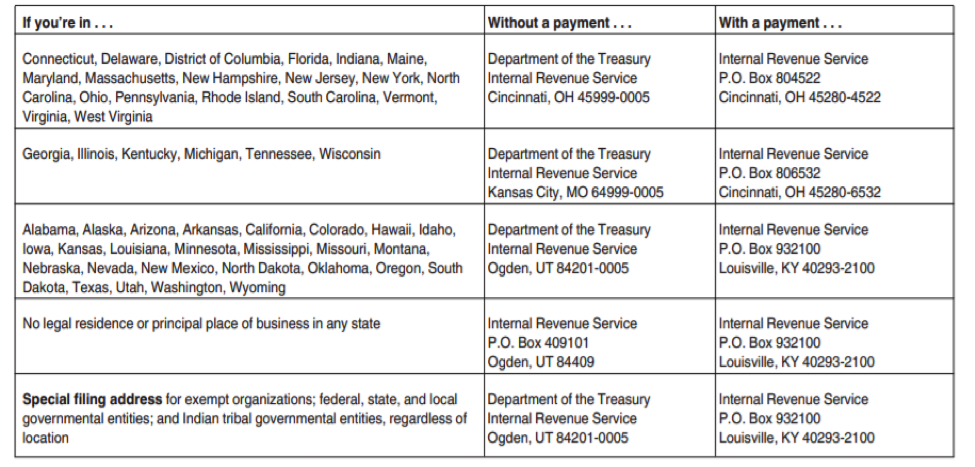

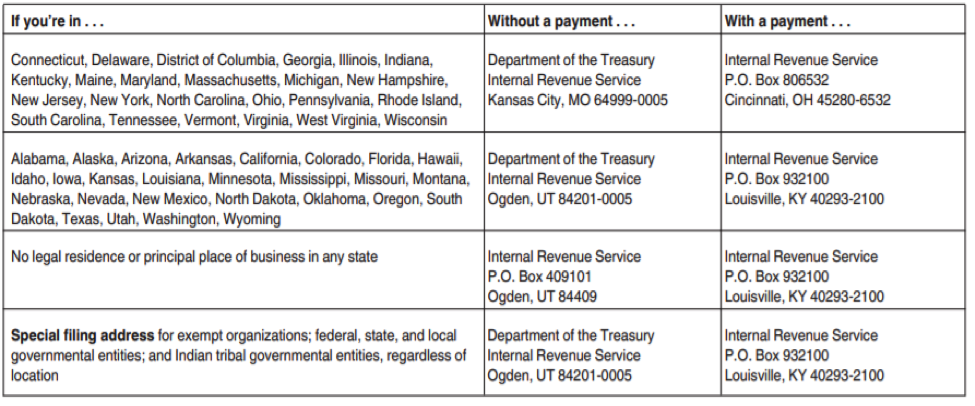

For the quarter ending March 31, 2019, the filing addresses have changed for some employers. The filing addresses will also change later in 2019 for some employers. Therefore, your Form 941 for the quarters ending June 30, September 30, and December 31, 2019, may be mailed to a different address than you used for the quarter that ended March 31, 2019.

Mailing Addresses for Returns Filed for the Quarter Ending March 31, 2019

Mailing Addresses for Returns Filed for the Quarters Ending June 30, September 30, and December 31, 2019

Social Security and Medicare Tax for 2019

The social security tax rate is 6.2% each for the employee and employer, unchanged from 2018. The social security wage base limit is $132,900.

The Medicare tax rate is 1.45% each for the employee and employer, unchanged from 2018. There is no wage base limit for Medicare tax. Social security and Medicare taxes apply to the wages of household workers you pay $2,100 or more in cash wages in 2019. Social security and Medicare taxes apply to election workers who are paid $1,800 or more in cash or an equivalent form of compensation in 2019.