Posts by IRS Compliance

What’s New for 2019 Form W-2

Employee stock options are not subject to Railroad Retirement Tax In Wisconsin Central Ltd. v. U.S., 138 S. Ct. 2067, the U. S. Supreme Court ruled that employee stock options are not “money remuneration” subject to the Railroad Retirement Tax Act (RRTA). If you are a railroad employer, do not withhold Tier 1 and Tier…

Read MoreWhat’s New for 2019 Form 941

New filing addresses For the quarter ending March 31, 2019, the filing addresses have changed for some employers. The filing addresses will also change later in 2019 for some employers. Therefore, your Form 941 for the quarters ending June 30, September 30, and December 31, 2019, may be mailed to a different address than you…

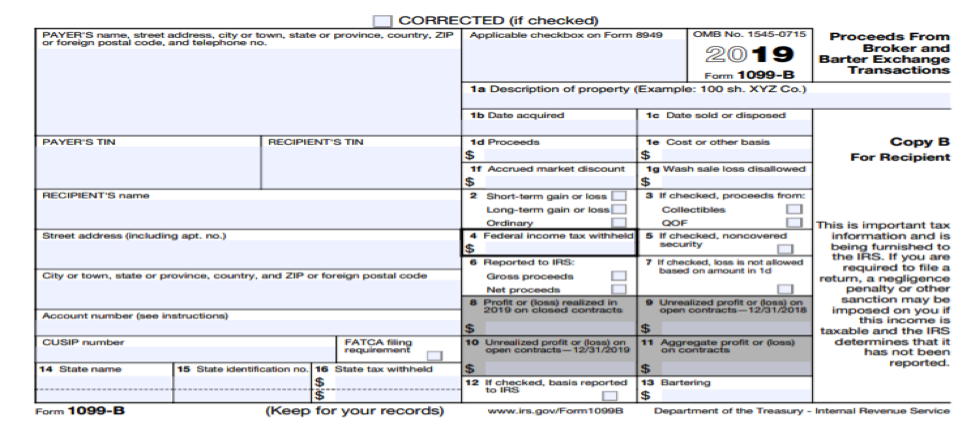

Read MoreWhat’s New for 2019 Form 1099-B

Reporting Dispositions of Qualified Opportunity Fund Investments A Qualified Opportunity Fund (QOF), whether or not the QOF is a broker or barter exchange, should file Form 1099-B, Proceeds From Broker and Barter Exchange Transactions, for each person who disposed of a QOF investment as defined in section 1400Z-2(d)(1). A Qualified Opportunity Fund (QOF) is an…

Read More