Posts by IRS Compliance

IRS Released Draft 2020 Form W-4

The Internal Revenue Service issued a draft of the 2020 Form W-4, Employee’s Withholding Allowance Certificate (PDF), that will make accurate withholding easier for employees starting next year. The revised form implements changes made following the 2017 Tax Cuts and Jobs Act, which made major revisions affecting taxpayer withholding. The redesigned Form W-4 no longer uses…

Read MoreEmployee or Independent Contractor

Which do you have? For federal tax purposes, this is an important distinction. Worker classification affects who pays the federal income tax, social security and Medicare taxes, and how tax return is filed. Classification affects the eligibility for social security and Medicare benefits, employer provided benefits and your tax responsibilities. If you are not sure…

Read More2019 Form W-2 Reporting of Moving Expense Reimbursements (IRC §132)

The IRS has clarified reporting moving expense reimbursements on Form W-2. The only amounts to be reported under ‘Code P’ for 2019 are excludible moving expense reimbursements paid directly to a member of the U.S. Armed Forces who moves per a military order and incident to a permanent change of station. Employers should not report…

Read MorePenalty Relief Due to Reasonable Cause

Once you have filed information returns with the IRS at yearend, you may ultimately receive a Notice from the IRS that proposes to assess penalties with respect to the returns that you filed. The IRS may issue Notice 972CG which proposes an IRC 6721 penalty for the information returns that were filed late, filed on…

Read MoreIRS Revises EIN Process

As part of its ongoing security review, the Internal Revenue Service announced that starting May 13 only individuals with tax identification numbers may request an Employer Identification Number (EIN) as the “responsible party” on the application. The EIN is a nine-digit tax identification number assigned to sole proprietors, corporations, partnerships, estates, trusts, employee retirement plans…

Read MoreWhat’s New for 2019 Publication 505 Tax Withholding and Estimated Tax

No longer a requirement to have minimum essential coverage. Beginning in 2019, you will no longer be required to either have minimum essential coverage, claim a coverage exemption, or report a shared responsibility payment on Form 1040. Standard deduction amount increased. For 2019, the standard deduction amount has been increased for all filers, and the…

Read MoreRequired Minimum Distributions (RMDs) for 2019

The Internal Revenue Service reminds taxpayers that, in most cases, Monday, April 1, 2019, is the date by which persons who turned age 70½ during 2018 must begin receiving payments from Individual Retirement Accounts (IRAs) and workplace retirement plans. You cannot keep retirement funds in your account indefinitely. You have to start taking withdrawals Individual…

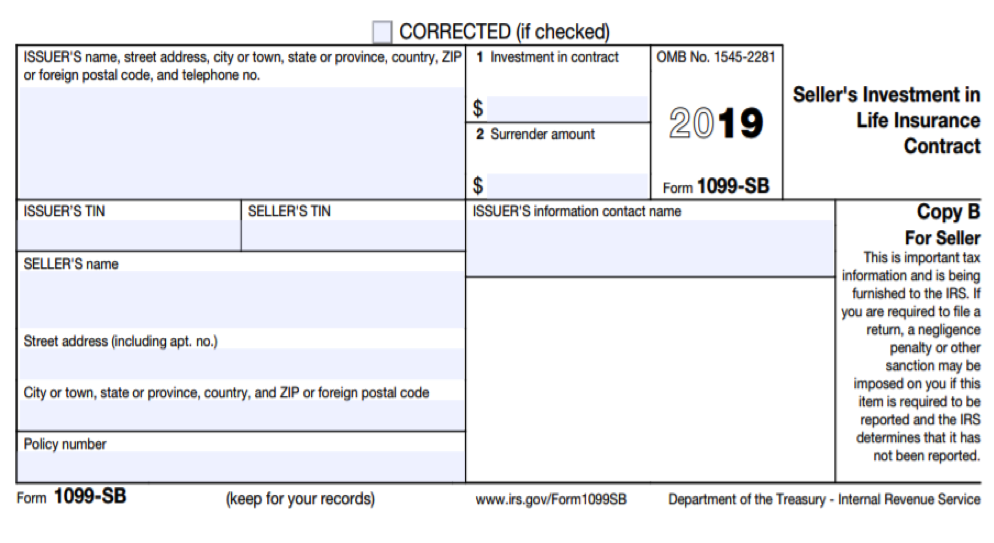

Read MoreForm 1099-SB – Seller’s Investment in Life Insurance Contract

File Form 1099-SB if you are the issuer of a life insurance contract and either of the following occurs You receive a statement from an acquirer in a reportable policy sale provided under section 6050Y(a), such as a copy of a Form 1099-LS, Reportable Life Insurance Sale, reporting the transfer of the life insurance contract,…

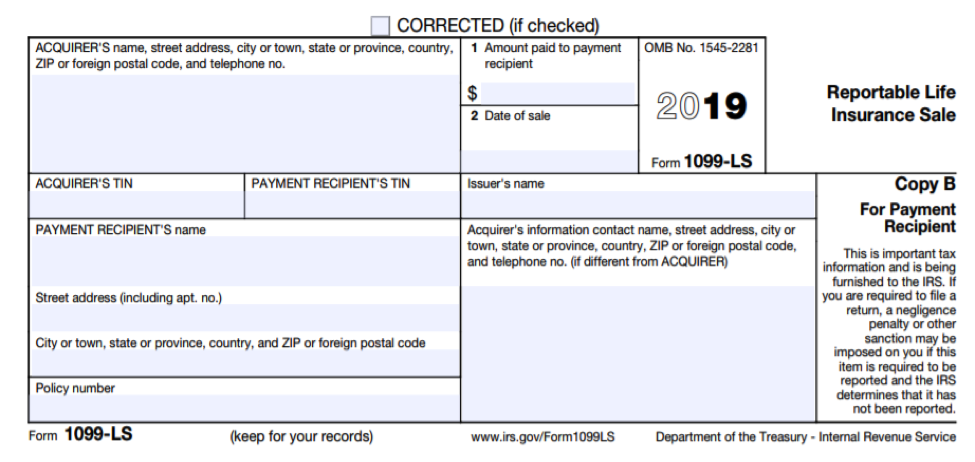

Read MoreForm 1099-LS – Reportable Life Insurance Sale

File Form 1099-LS if you are acquirer of a life insurance contract (also known as a life insurance policy), or any interest in a life insurance contract, in a reportable policy sale to report the acquisition. A reportable policy sale is any direct or indirect acquisition of a life insurance contract, or any interest in…

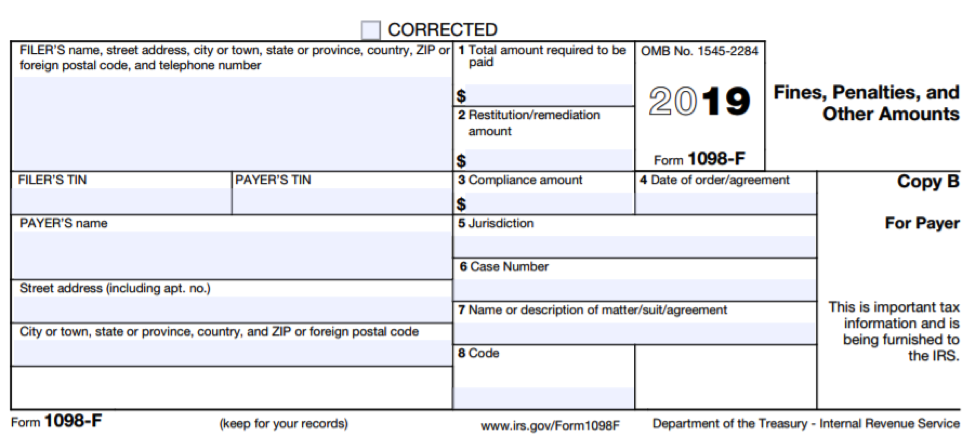

Read MoreNew Form 1098-F – Fines, Penalties, and Other Amounts

Form 1098-F is a new form required by section 6050X, section 13306 of P.L. 115-97, the Tax Cuts and Jobs Act (TCJA), as enacted by the 2017 tax act (Pub. L. No. 115-97), effective for amounts paid or incurred after December 22, 2017, requiring reporting of certain fines, penalties, and other amounts. The Form and…

Read More